There is increasing consensus amongst market participants that generating alpha (outperformance) will get more difficult going forward because markets will be more dispersed. As the crypto market matures, catching trending narratives and rotations are tough. I think we will have to develop a framework for identifying sector rotations early. This article is an attempt to build the foundations for this framework.

To understand how sector rotations work, we can look at traditional stock markets for clues and possibly adapt it to digital assets (crypto).

What is sector rotation in traditional markets?

During an economic recession, investors may move funds from energy (oil companies like SHELL) to utilities (electric power companies) or consumer staples (coca cola) because coca cola will still do well. The idea is that if there is a recession, consumers will still drink coke and the company would still do well leading to good results and dividend payments. While energy companies like shell may earn less as consumers spend less on gasoline.

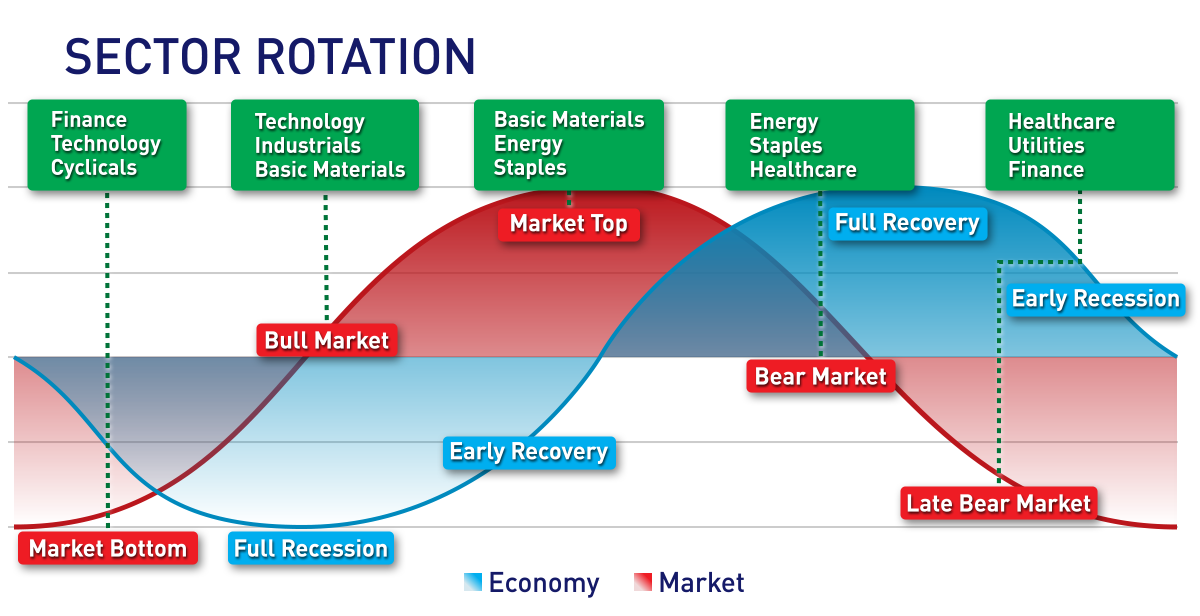

Below is an illustration of sector rotations in stock markets. I won’t be going deep in detail since our focus is on crypto, this shows how sector rotation generally works.

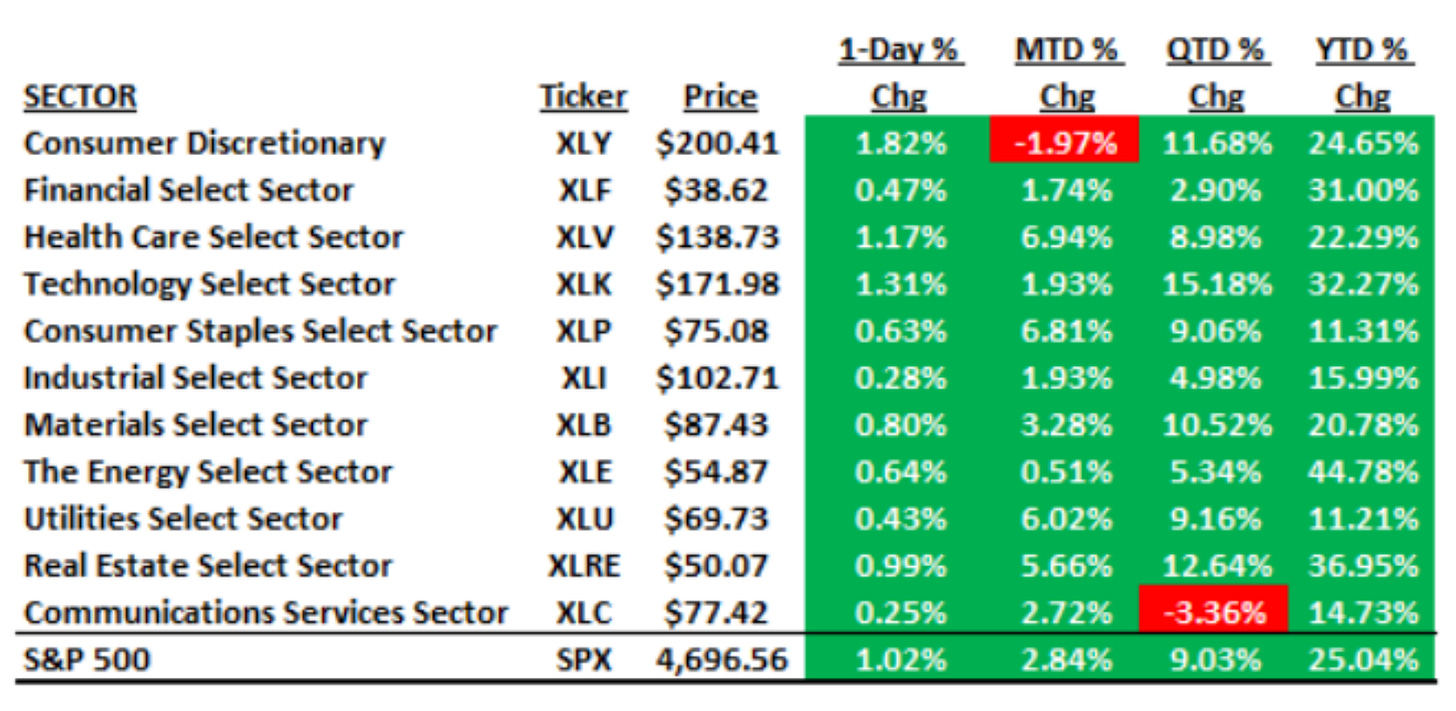

Examples of Stock Market sector outperformance

If you compare the figures in the month-to-date (MTD) % change column, notice that utilities and consumer staples sector has been doing well in the month of December 2021. Perhaps it is due to FED tapering so market has been allocating more into risk off dividend yielding companies or could be for other reasons. Whatever the reason is, these two sectors outperformed by about 2x, 6% returns vs market average of around 2.84%. It’s similar in crypto, just within different sector names.

What are the sectors in Digital Assets (Crypto)?

Messari has broken down the digital assets space into eight sectors (image above). I think the number of sectors may grow or people may further break down sectors into sub-sectors.

Here is how I would breakdown the digital assets ecosystem into the following sectors and sub-sectors for my own understanding:

Smart Contract Platforms

Layer 0

Layer 1

Layer 2

Stablecoins

Asset backed stables (RAI / FEI / MIM)

Partial asset backed stable (FRAX)

Algo stables (UST)

Decentralized Finance

OG DeFi (Aave, YFI, Mkr)

Defi 2.0 (RGT, ALCX, TOKE)

Derivatives platform (DYDX / RBN / DPX)

Asset Management (Popsicle / YFI / CVX / BTRFLY)

Metaverse / GameFi

Gaming (AXS)

Virtual Land Ecosystem (MANA / SAND)

Guilds / Ecosystem Management (GuildFi / MC)

Web 3 Infrastructure

MEV (ROOK / EDEN)

Smart Contract Automation (GEL)

Data/File Storage (AR / GRT)

Examples of Crypto sector/sub-sector outperformance

The chart patterns clearly show that the coins are resilient and outperforming majors during their respective bull market. These are the type of coins investors need to take notice and invest in. I won’t post the charts here, as I think most of you know these already.

Defi 2.0 vs OG DeFi

SoLunAvax vs Dino Coins (ADA/VET/EOS)

JEWEL resilience in Dec 2021 while most ALTs were down 40-50% from ATH.

SAND/MANA rotation after FB announcement

How to prepare for a dispersed crypto market structure?

Having a deeper understanding on what works and what doesn’t will be crucial. It is only logical that a protocol that works well will have more users, more TVL, more revenue, which leads to more demand for tokens. Understanding the protocol you invest in will provide conviction to hold, after all, why sell a 2x when the coin could go 20x?

Go deeper into the vertical - To develop deeper understanding, investors must go deeper into the vertical, only then will you understand what may be successful and become the “meta”. For example, understanding the different liquidity providing protocols, the move from LPs to Protocol Rented Liquidity (TOKE / ONDO) and Protocol Owned Liquidity (OHM) would have helped you decide if you should invest in TOKE. I totally missed TOKE because I was not looking deep, I was looking broad into many different sectors.

Consider what tokens will remain resilient during corrections or bear markets - Understanding the incentives for token holders to HODL their tokens is increasingly important. For example, during the recent dips, all over CT feed you could see people show charts of how resilient CVX was. Why is that so? Everyone wants to buy the CVX dip, strong holders don’t want to sell. If you knew the why, holding would be easy and you would probably buy the dip and prices went from a low of $19 to $42 in just 3 weeks.

Note that there will always be bright spots somewhere - The market has shown us that there will always be bright spots somewhere. OG Defi tokens like Aave and YFI had been in a bear market for almost a year, while Defi 2.0 tokens like Spell and Time have gone up to 100x. Accept the fact that you will need to put in more work to outperform in the markets instead of just hodling BTC or any other coin. TLDR; when X sector is in a bear market, Y sector may be in a bull market.

Document what is happening within your focus sectors – monitoring broad sector price performance can help identify outperforming coins. Usually, there is a reason why one coin is outperforming another. Once you find a outperforming coin, research and dig for potential catalysts or reasons. If you are up to date within a the cross-chain infrastructure, you may know that Anyswap is changing name to Multichain and will have new tokens coming out soon. In addition, Synapse will be introducing stacked SYN which could trigger more buyers wanting to accumulate tokens for staking. At times, re-branding could be a signal that something new is coming and potentially attention could shift here.

Find your tribe - one person can’t keep track of everything in the space. To navigate the rotations, we will need at least a few people monitoring different sectors of the digital assets space. Gather a group of friends and start sharing good quality information with one another. That’s how you can make it in this space.

Finding the next Rotation

While the traditional markets have sector rotations based on economic or business cycles, I think it is still not clear how sectors rotate in crypto. Crypto rotations today have been based on fund flow momentum and attention capture leading to a narrative. Here’s an example: Facebook is getting involved in the metaverse -> buy metaverse coins -> MANA / SAND explodes.

Most important question to ask here is how to figure out where the funds will flow next?

I will try to lay out my thoughts below.

Think about the long-term thesis -> for crypto to onboard the next 1bil users -> fees must be affordable -> does which L1/L2 chain matter?

What kinds of users?

Earning a 20% yield in Defi vs 0.25% in your bank?

Gaming (gaming companies moving into blockchain games) -> Axie Infinity has already onboarded the retail wave (a lot of users) -> GameFi will likely continue to onboard the next billion users. @Jedihornet and I had discussed about our thoughts, and 2022 seems to be the year for GameFi to really outperform. However, we will likely have to see a move from Play to earn (P2E) to Play and Earn (P&E) model. Defi Kingdom and Crypto Raiders seems to fit the bill for this.

What do current defi users lack?

Limit orders in DEXs

Think about investing in DeFi ecosystems versus a single protocol

Should I be investing in uniswap when sushiswap is going to be part of the Dani ecosystem, which potentially has synergies and funds may flow to sushi because of potentially more users soon?

Perhaps a look into the Tribe ecosystem could be a good play for 2022.

These are just some of my thoughts generated from discussions with friends in the space. You may form your own views as you participate in the Digital assets space and experiment with different protocols.

Current Rotations in play

ve-XYZ tokens

Cobie’s metagame article inspired me to think deeper into the current rotations. What is already successful and developers are replicating has been the ve-tokenomics. This is not a rotation in a particular sector or sub-sector but a rotation to all DeFi tokens with ve-tokenomics.

It started with Curve with veCRV. FXS has veFXS too. In a recent article, YFI hinted of a potential shift to ve-tokenomics. It is also public knowledge that both DPX and RBN are developing their own veDPX and veRBN tokens as well. Then, there are protocols like Convex Finance (CVX) that built a platform to control veCRV and veFXS. Most recently, Redacted Cartel (BTRFLY) was launched and plans to accumulate CRV/CVX and subsequently FXS & DPX tokens.

You get the idea, the trend is obvious, ve-XYZ is the “meta”. Market participants who know the flywheel effect are accumulating tokens that have these tokenomics. The ve-tokens have been resilient in the recent correction. Are we early? Probably not. Are we late? Probably not. I personally think we are in the middle of this rotation.

Fantom/Atom/Near (FAN) – L1 sector (Laggards)

The FAN tokens are playing catch up to “SoLunAvax”, the price action is showing this clearly. Out of these 3 tokens, all eyes are on FTM. Both Andre Cronje and Daniele will be building on FTM network, two heavyweight developers on a chain, that’s an investable narrative that should playout for some time.

Concluding thoughts

Where funds flow depends on who the market participants are, and what their goals are. If more institutional investors come into the space, they are unlikely to invest based on hype, there are frameworks to follow.

Thinking about how they work and why they deploy capital to a particular sector or token will be an important discussion going forward.

Thoughts about staying power and mind share will also be essential discussions because there are so many tokens to invest in, yet so little that are good and will remain the “meta” for you to see a 10x or 100x. In addition, 2022 brings regulatory risks, would this cause a rotation into tokens that do not face regulatory risks? It is probable, hence thinking about where funds in DeFi tokens will rotate to. Will it be anon DeFi protocols? Or Metaverse tokens? That’s up for discussion when the regulatory risks come closer.

As mentioned at the start of the article, I am penning thoughts down to set a foundation of how I am thinking about rotations (sector/sub-sector/individual tokens) in the digital assets space.

Sector rotation models in tradFi can form a guide to how the rotations in digital assets space will pen out, but nothing is set and stone yet as we are potentially just starting to see the new crypto market structure pen out. Will be sharing more thoughts on this as more research is done. Will be happy to hear thoughts and feedback to build this model together.

options yield strategy smart contract protocols could be big in 2022 aswell?